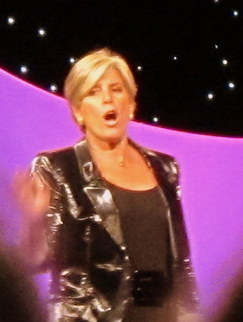

Suze Orman Background

Economy

Suze believes 2015 is when things will start to turn around.

That is hard for a lot of us to hear, but I honestly believe there is a silver lining, and that silver lining is we all have a great opportunity here as a collective to learn from our mistakes with money and get back on track! We can help motivate each other to halt the spending on wants that are not needs. This is hard and much easier to do as a group. See if you can get together with your friends and give each other ideas of ways to cut down on spending. What I have learned from Suze is that we should NOT be afraid to talk about money. Our self worth isn’t in dollars and it is time we start really acknowledging that!

Living Your Best Life

“Live below your means but within your needs.” ~Suze Orman

How many of us actually live below our means these days? The thing about money is- the more your make, the more you spend! It seems in today’s world we are really lucky if we manage to live within our means. Below your means- that is a whole different ball game! Together we should all strive to help each other join in.

Suze says, “Stop trying to impress others with money you don’t have.”

This really got me thinking about how crazy it is that we spend money to try to impress one another. Let’s stop this!

“Stop saying yes out of fear about what others will think about you and say NO out of love for yourself!” ~Suze Orman

This really has me thinking about the upcoming holiday season. To me it is a classic example of a time we spend money to impress one another. A time we spend too much money on things we do not need- gifts, decor, holiday parties, holiday outfits! My husband and I are already thinking long and hard about what we want to do in terms of our holiday spending this year, and ways we can apply Suze’s advice to our own family.

Savings

Another important note Suze made- if your company has a 401k matching plan you should absolutely make sure you max out the contribution. You cannot afford to be missing out on ‘free’ money!

If you are managing to save properly for yourself first- minimum 8 month emergency fund & retirement, she also mentioned a 529 education savings plan for your children.

Remember “When you undervalue yourself, the world will under value you. You are passing the message of less.” ~Suze Orman

YOU are more important than stuff!!!

Real Estate

Suze’s answers to this is ONLY when you can afford to!

How do you know you can afford to?

· You can put at least 20% down

· You have a minimum of an 8 month emergency savings fund

· You can afford a 30 year or 15 year fixed rate mortgage

· You have a secure job

· The home must be a STEAL OF A DEAL!! Suze says this is so important! She gave us an example of condos in Florida that many people thought were a great deal at $150,000 that are now worth $5,000!

Suze does not believe the real estate market is going anywhere until 2023!

That means you should not be in a rush to buy, and only do so if you can afford to by meeting the above criteria.

Let’s be a positive influence on each other with how we handle our money. Let’s start talking about money!